Finance & Fundraising News

12 Ways DTC Founders Can Respond to the Decline of Cookies & Third Party Data

When Apple released the landmark iOS14 update in 2021, it permanently changed digital marketing. Along with giving iPhone users the option to review and restrict how third parties could track their activity and data, Apple also upped the ante on App Tracking Transparency (ATT) and Privacy Nutrition Labels for app developers. Firefox and Safari quickly…

Read MoreRaising Capital 1 Year into COVID-19

In April 2020, Dwight Funding and Stage 1 Financial each hosted virtual forums around Raising Capital during COVID, one of the most uncertain periods in history. As we enter the post-COVID era, our groups have joined forces to bring a timely update on the current fundraising environment. Watch full State of the Market webinar here:…

Read MoreTackling Supply Chain Challenges to Meet Post-Pandemic Demand

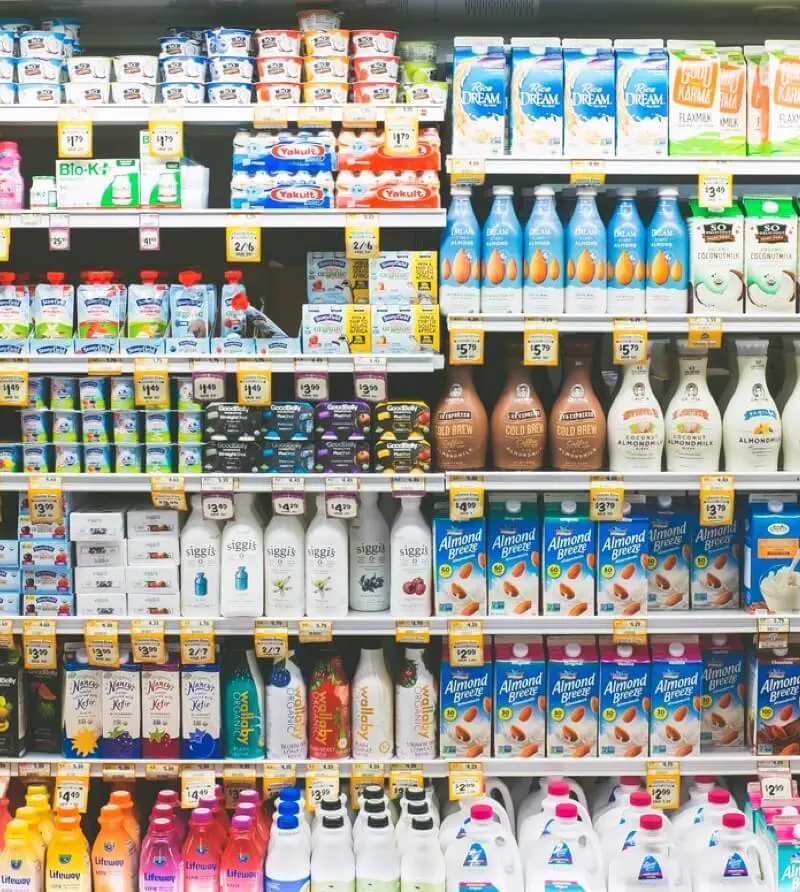

While there’s no denying supply chain logistics are always evolving, it’s safe to say 2020 caused disruptions that most consumer goods brands aren’t accustomed to seeing. Now, in 2021, there are new challenges companies must tackle to remain successful within the competitive eCommerce space. With that said, a shift to online retail, increase in consumer…

Read More2021: The Year of the SPAC

Interest in SPAC acquisition as a potential exit strategy is greater than ever for growing brands. We are always looking for new ways to add value beyond our core focus in working capital financing. In that spirit, we’ve utilized our ties in the Consumer, Food & Beverage and SaaS spaces to curate a brief list…

Read MoreRaising Capital and Pursuing MA in Uncertain Times

Raising Equity During and After COVID

Key Webinar Takeaways The Dwight Team has seen some changes in the growth stage CPG investor sentiment over the past year, and we continue to see changes as the COVID crisis develops. Jessica Bates from our team sat down with Dayton Miller (Managing Partner, Boulder Food Group), Jared Stein (Co-Founder & Partner, Monogram Capital) &…

Read MoreNoosa Founder’s Advice for Entrepreneurs: Ask For What You Want

Don’t Say “No”-Use the Opportunity to Forge a Relationship

As a trusted advisor to your small business customers, you never want to be the one to say “No”. Nonetheless tightening regulation is making “No” an increasingly common answer. “No” your company is too early to receive bank lending “No” the facility size requested is too small “No” we can’t work with companies with historical…

Read More