2023 presented it’s fair share of both opportunities and challenges for digitally native and omnichannel brands in the consumer products space. Investors adopted a more conservative approach than previous years, forcing many brands to pivot growth strategies to focus on profitability at all costs.

Despite having to make some fundamental strategic changes, many brands are ending the year on a positive trajectory with big plans for the New Year. In this blog, we’re sharing noteworthy growth metrics from within our portfolio as well as the broader CPG industry. Join us in taking a look back at 2023.

Portfolio by the Numbers

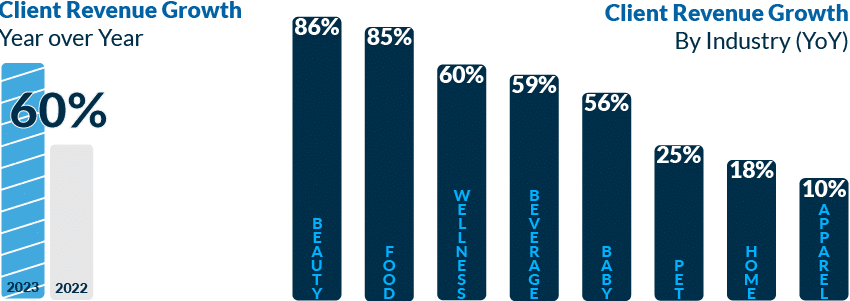

As our portfolio grows in quality and quantity, we’re continuously impressed by the growth and innovation of our partners.In 2023, bottom line growth was driven by retail expansion and streamlined operations. Plus, clients leaned into Dwight’s non-dilutive financing more than ever as investors tightened their purse strings.

Consumer Fundraising Trends

Fundraises

Stay up-to-date on the latest fundraises in your Consumer category with the help of our comprehensive index of brands that brought in investor capital each quarter.

Trends

Plus, we’ve been following along as brands secured fresh funding, collaborated with each other, launched behind new doors, released new products, and exited the space. Here are some standout trends from 2023, according to Dwight.

Haircare

The Skinification of Hair

Fragrance

The Fragrance Frenzy

Supplements

Personalization & Premiumization of Care

Functional Beverage

RTD Caffeine & Energy Drinks

Looking back…

“In 2023, there was a notable shift in the consumer goods sector, affecting companies at various stages of growth. Brands crossing the $30-$50 million revenue threshold entered the mainstream spotlight, leading to a dramatic increase in both revenue and profitability. This year was a turning point for these larger players as they evolved into key market influencers.

At the same time, early-stage brands focused on refining operational efficiency and improving profitability. Their aim was to optimize their operations, which helped extend their financial runway and move towards sustained profitability. Throughout these shifts, investor interest remained robust. Investors kept an eye out for, and actively supported, brands that not only had strong fundamentals but also showed a clear potential for growth.”

Ben Brachot

Co-Founder + Managing Director

CPG Insights & Resources

We’ve tapped into our market, data, and expertise to publish valuable content for brands and the community that supports them. In case you missed it, check out some of our most popular insights and resources from 2023: