Dwight x Eventus 8-Step Implementation and Management Guide

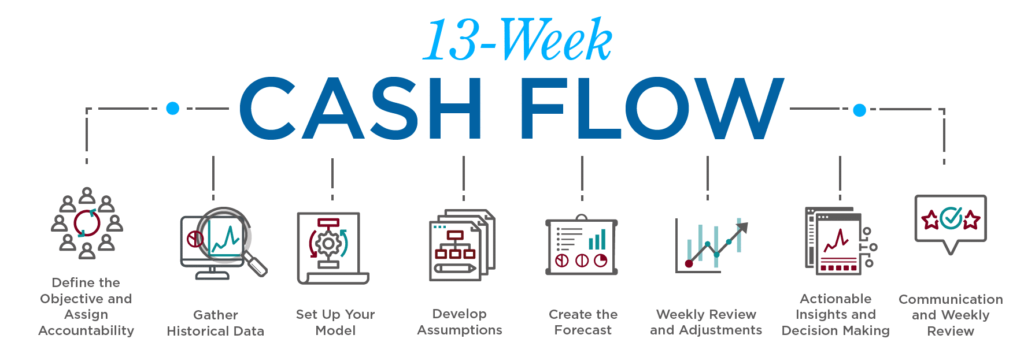

If you’ve read our previous blog, Seven Tips for Maximizing Cash Flow, you’re familiar with our top recommendation for managing unpredictable cash flows: the 13-Week Cash Flow Model. This powerful tool offers a near-accurate reflection of your company’s liquid cash balance, down to the dollar. However, the seemingly heavy-handed setup and maintenance requirements can be daunting for busy founders and finance departments. That’s why we’ve joined forces with the full-service fractional Accounting and CFO group, Eventus Advisory Group, to simplify the process into eight straightforward steps.

Step 1: Define the Objective and Assign Accountability

The initial step in developing a 13-week cash flow model involves establishing a clear objective and assigning responsibility for the model. The primary goal is to manage liquidity efficiently, identifying potential cash shortfalls in advance, and supporting informed decisions on operations, investments, and financing.

Objective Clarity

Articulate your goal, whether it’s ensuring operational liquidity, strategic planning for growth, maintaining covenant compliance, or demonstrating proactive financial management to stakeholders. Reminder that this exercise accounts for transaction activity on a cash basis, as the focus is on actual cash transactions, both inflows and outflows.

Assigning Accountability

Who:

Designate an individual, ideally someone with deep financial knowledge like a Controller, Financial Analyst, or a Fractional CFO.

Responsibilities:

This includes regularly updating the model with accurate data, analyzing variances, communicating insights to management, and adjusting the model as needed.

Skills Required:

The responsible party should have strong analytical skills, attention to detail, and the ability to compile and communicate complex financial information clearly.

By clearly defining the model’s objective and assigning specific accountability, you ensure the tool effectively supports your financial management and decision-making processes.

Step 2: Gather Historical Data

Start with collecting historical financial data for the past 12+ months. This data should include detailed records of cash receipts and disbursements, sales, collections, and payment cycles. Historical data is crucial for identifying patterns and trends that will inform your forecasting.

Step 3: Set Up Your Model

Create a spreadsheet with a time horizon of 13 weeks, broken down by week. The model should have three main sections: Cash Inflows, Cash Outflows, and Net Cash Flow. It’s also useful to include a beginning cash balance and an ending cash balance for each week.

Bypass this step with our free, readymade 13-Week Cash Flow template. Enter your email in the space below to get started.

Cash Inflows

Accounts Receivable Collections: Forecast weekly collections based on historical collection periods and sales forecasts.

Cash From Customer Deposits: If your business takes customer deposits, be sure to include them in your inflow section.

Non-Aged Collections (eCommerce): If you have real-time sales, such as in an eCommerce or retail business, be sure to analyze trends from historical periods as well as discuss with marketing any upcoming promotions that could impact sales levels. Remember to forecast net sales (net of returns, credit card merchant fees, and discounts).

Other Income: Include expected income from other sources like asset sales, tax refunds, or any other cash inflows not related to main operations.

Cash Outflows

Operating Expenses: Break down by category (e.g., payroll, rent, utilities) and forecast based on historical spending patterns and anticipated changes.

Capital Expenditures: Schedule any expected purchases of long-term assets.

Debt Service: Include weekly interest and principal payments.

Other Disbursements: Any other cash payments not included above.

Step 4: Develop Assumptions

For each line item in your inflows and outflows, develop realistic assumptions based on historical data, current conditions, and forward-looking projections. These assumptions are the foundation of your forecast and must be revisited and adjusted as new information becomes available.Cutting the Fat: Streamlining & Eliminating Unnecessary Expenses

Step 5: Create the Forecast

Using the setup from Step 3 and the assumptions from Step 4, populate each week with projected cash inflows, outflows, and calculate the net cash flow (Inflows – Outflows). Summarize with a calculation of the ending cash balance each week by adding the net cash flow to the beginning balance.

Step 6: Weekly Review and Adjustments

A 13-week cash flow model is a living document. Conduct weekly reviews to update the model with actual results and compare them against your forecasts. Adjust future weeks’ forecasts based on these actuals and any changes in the business environment or operations.

Step 7: Actionable Insights and Decision Making

Use the insights gained from the model to make informed decisions on managing liquidity. This might include identifying the need for additional financing, adjusting payment terms with suppliers, cutting operational expenses, or making strategic decisions on capital spending.

Step 8: Communication and Weekly Review

Share the findings and implications of the cash flow model with key stakeholders, including management, investors, and lenders. Meetings should occur on a weekly basis to ensure all stakeholders are operating with the most recent information. Clear communication ensures everyone is aligned on the company’s financial position and any necessary actions.

Questions that should be addressed when reviewing or presenting this model to management are as follows:

Sales and Revenue

Upcoming Promotions and Impact: “What promotions or sales initiatives are we planning in the next 13 weeks, and what impact do we expect them to have on sales volume and timing of cash receipts?”

New Products or Services Launch: “Are there any new products or services being launched that could affect our sales forecast? What are the expected sales from these new offerings?”

Significant Contracts or Deals: “Do we have any significant contracts or deals closing that should be included in our cash inflow projections? What is the probability and timing of these receipts?”

Accounts Receivable

Changes in Payment Terms or Customer Behavior: “Have there been any recent changes in payment terms with major customers or shifts in payment behavior we should be aware of?”

Outstanding Receivables Issues: “Are there any significant outstanding receivables that are at risk of not being collected on time? How should we adjust our collections forecast?”

Operating Expenses

Fixed and Variable Cost Adjustments: “Are there any expected changes in our fixed or variable costs? How should we adjust our cash outflow projections accordingly?”

Significant Upcoming Expenses: “Are there any large, one-off expenses coming up, such as annual insurance premiums or tax payments, that we need to account for?”

Capital Expenditures and Investments

Planned Capital Expenditures: “What capital expenditures are planned for the next 13 weeks, and what are the payment terms? Are these expenditures flexible or committed?”

Investment Requirements: “Do we have any investments in projects or joint ventures that require cash contributions during this period?”

Debt and Financing

Debt Repayments: “Are there any debt repayments due in the next 13 weeks? What are the terms, and are there any options for refinancing or deferral?”

Interest Payments: “What are the scheduled interest payments on our existing debt facilities?”

Inventory and Supplier Payments

Inventory Purchases: “Based on our sales forecast, what inventory levels do we need to maintain? What are the payment terms with our suppliers? Have they changed?”

Supplier Negotiations: “Have there been any negotiations with suppliers that could impact on our payment terms or timing?”

Miscellaneous

One-Off Payments and Deposits: “Do we need to make any one-off payments or deposits to vendors or partners? Are there any refunds or rebates we expect to receive?”

Contingency Plans: “What contingencies do we have in place for unexpected expenses or shortfalls in cash flow?”

Conclusion and Additional Tips

Accuracy is key: Ensure data accuracy and realistic assumptions to maintain the integrity of the model.

Flexibility: Build your model to be easily adaptable as new information comes in.

Simplicity: While detail is important, avoid overly complicating the model. Keep it user-friendly.

Consistency: Use consistent methodologies for forecasting and updating the model.

Implementing and maintaining a 13-week cash flow model is not just about managing a spreadsheet; it’s about developing a deeper understanding of the financial rhythms of your business and using that knowledge to drive strategic decisions. With discipline and regular review, this tool can be a cornerstone of successful financial management and turnaround strategies.

About Eventus Advisory Group

Eventus Advisory Group is a leader in on-demand finance and accounting support services. From accounting and Controllership to CFOs and SEC reporting, we provide public and private companies with a cost-effective option to manage, build-out, or augment their internal finance teams, systems and processes. Whether you need to fix, adapt or grow your business, Eventus provides an on-demand solution. Learn more at www.eventusag.com.

Need expert help getting started on your 13-Week Cash Flow model? Connect with the Eventus team directly to explore their accounting and CFO services can benefit your scaling business.

GREG LOPEZ

Director

glopez@eventusag.com

MARK STOLLER

Sr. Manager, Business Development

mstoller@eventusag.com